One of President Lazarous Chakwera’s pool of advisors, Pastor Martin Thom spent few hours in the cooler yesterday in relation to a Loan Authorization Bill that was smuggled to Parliament to allow government borrow about K93 billion from Bank of Baroda, for construction of 3, 253 houses for various security agencies.

And it has been revealed that The Bank of Baroda (BoB) also played a crucial role in allowing South Africa’s politically influential Gupta family to move hundreds of millions of dollars linked to alleged dirty deals into offshore accounts, an investigation by the Organized Crime and Corruption Reporting Project (OCCRP) and The Hindu founded out.

BELOW IS THE ARTICLE PUBLISHED BY THE HINDU ONLINE NEWSPAPER IN 2018;

Interviews and documents obtained by reporters show that the bank’s South African branch issued unapproved loan guarantees, quashed internal compliance efforts, and prevented regulators from learning about suspicious transactions in a way that benefited the Guptas’ network.

This report reveals new details of a scandal that has rocked South Africa in recent months.

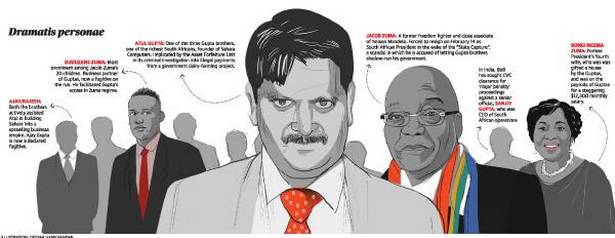

The Gupta brothers — Atul, Ajay, and Rajesh, who immigrated to the country from India in the 1990s — are accused of using their money and influence to pursue a project of “state capture”, in collaboration with former President Jacob Zuma, to enrich themselves at the expense of taxpayers.

The scandal led to Zuma’s resignation under pressure from his ruling African National Congress (ANC). Earlier on the same day, the police raided the Guptas’ Johannesburg mansion and have issued an arrest warrant for Ajay. The three brothers, as well as the former president’s son Duduzane, are on the run and believed to be in Dubai.

Duduzane Zuma is accused of being a key player and beneficiary in the Guptas’ financial dealings. His father appointed many of the key officials that made the family’s schemes possible.

At the core of these was the South African branch of the BoB. The documents obtained by reporters show the bank was host to hundreds of millions of dollars worth of suspicious transactions.

One of the larger deals that appears in the transactions is the Guptas’ irregular acquisition and allegedly illicit sale to themselves of a major South African coal mine.

The revelations in the documents follow the bank’s announcement in mid-February that it was shuttering its South African operations.ALSO READL’affaire Jacob Zuma: How the Guptas became Zuptas in South Africa

The head of the Bank of Baroda’s South African branch, Sanjiv Gupta, may face disciplinary action over the bank’s business in the country. (He is not related to the Gupta brothers.)

A senior Indian government official, who asked to remain anonymous, said the bank had asked the Central Vigilance Commission, the country’s top anti-corruption body, to initiate penalty proceedings against Sanjiv Gupta, which could result in his dismissal.

Revolving funds

The three Gupta brothers have for years been major players in South African business. After immigrating from India, they ran a computer hardware company called Sahara Computers, named after their hometown of Saharanpur. But their business really started to grow after they developed a relationship with Zuma, who was then Deputy President, in 2003. Both parties benefited from an arrangement in which the Guptas allegedly provided Zuma’s family with financial support while he provided access to lucrative state tenders and appointed friendly officials. Since then, the Guptas have moved into the mining and media industries, eventually building a large empire that made the family one of South Africa’s richest.

Their rise has not been without controversy. Previous reporting by the OCCRP showed how the Gupta empire earned millions on the back of Transnet, the country’s main transportation infrastructure firm. The Guptas’ alleged large-scale raiding of South Africa’s public purse has for years been a public preoccupation in the country, particularly after the details were made public in the 2016 release of a critical report, “State of Capture”, by former public protector Thuli Madonsela.

Over the years, the Gupta family has run afoul of several South African banks, including Standard Bank, Nedbank, and ABSA, which all shut down their businesses’ accounts citing risks to reputation. In recent years, the BoB’s South African branches, which the Guptas have used since 2005, took on a crucial role as the family’s preferred financial institution.ALSO READThe Guptas of Saharanpur: A family at the heart of Jacob Zuma’s troubles

Years of transaction records obtained by the OCCRP and The Hindu, as well as internal documents and audits, shed new light on how exactly the Gupta family made use of the bank for nearly a decade.

The documents show a wealth of suspicious transactions among several of the Guptas’ real companies and a series of shell companies controlled by the family. A key Gupta associate who appears in many of the transactions is Salim Essa, a director and shareholder in some of the companies, who is believed to be the financial architect of many of the deals. The transactions include a number of back-to-back loans and other transfers that have no apparent legal or business purpose, leading to suspicion that they were used to disguise the origin of the money. Especially large amounts moved in and out of Sahara, the firm at the apex of the Gupta empire.

Close to 4.5 billion rand (about $532 million, based on an average exchange rate over 10 years) was transferred among the companies between 2007 and 2017. As a whole, the amount of cash flowing through the Gupta accounts was so large that it dominated the transactions of the entire BoB branch in Johannesburg.

In some cases, the significant benefit to the Guptas and their allies was clear. The BoB account of Atul Gupta, for instance, shows that he received 57.3 million rand ($4.8 million) from Westdawn, one of the shell companies, in a single transaction on March 26, 2015 (while reporting taxable income of just 1 million rand ($80,000) two years prior). Some of the money enriched former President Zuma’s son Duduzane, who held shares in a number of the companies that received large transfers.

The Gupta-controlled Westdawn, which held a BoB account, provided Gloria Ngeme Zuma, one of the former President’s wives, with a 160,000 rand ($12,300) monthly salary for a position she held at one of their firms.

But many of the transactions were more complicated. It raises the question whether their purpose was to disguise the origin of money as it entered the Gupta empire — much of it obtained through friendly state companies and cosy contracts — and blend it together to the point that it could no longer be tracked. At least some of the funds that flowed through the bank ended up in accounts controlled by the Guptas as far away as the U.K., Hong Kong, and even the U.S.

Many of the transactions lacked adequate documentation about the purpose of the transfers, as is required in South African banking regulations. Other times, information was included, but did not make sense. For example, on June 14, 2016, the Gupta-controlled Koorfontein Mine wired 100 million rand ($6.5 million) to a Gupta-controlled mining company called Tegeta for “[environmental] rehabilitation”, meaning repairing damage caused by mining activity. But Tegeta does not itself offer such services, which are typically handled by outside contractors, raising the question of the real purpose behind this transaction.ALSO READThe Gupta family: Saharanpur’s Rani Bazaar still in awe of their meteoric rise

One particular pattern shows up frequently in the transactions: inter-company loans with no “apparent legal or commercial purpose”. For instance, on January 18, 2017, transactional paperwork shows that Trillian Management Consulting, at the time majority-owned by Gupta associate Salim Essa, loaned 160 million rand ($11.8 million) from its BoB account to another Gupta company, Centaur Mining. The actual loaned funds passed through another similarly titled company, Trillian Financial Advisory. However, while the transactions describe a loan, no loan documentation could be found and there was no explanation for why the funds for the loan were provided by another company.

Internal documents also show that some of the funds originated with two state-owned companies: Eskom, an electricity utility, and Transnet, a railroad company. (The Guptas’ dealings with Transnet were detailed in an earlier OCCRP report.)

In June 2017, Eskom alone paid 466 million rand ($36.3 million) to Trillian for “management and financial services” at a time when Trillian had few employees and could not have performed the work. Internal BoB documents noted that bank employees filed alerts about several irregularities about the payments, including the fact that some were made on the same day as invoices were received (giving Eskom no time to assess the value of the work) and the fact that, for some reason, some of the payments were made to accounts held by other companies.

Despite this, the BoB kept doing business with the two dozen shell companies controlled by the Gupta inner circle. The bank’s employees dutifully filed suspicious activity reports (SARs), which banks are legally required to file with regulators whenever they see suspicious or potentially suspicious activity. On some days, they filed as many as half-a-dozen SARs related to the Guptas’ transactions. However, BoB managers often stepped in and voided the reports, marking the transactions as “genuine”. As a result, most of the SARs never reached the South African Financial Intelligence Centre, the state body in charge of reviewing and acting on them.

Rising transactions

In 2016, the BoB transactions spiked dramatically even as other South African and foreign banks closed out their own Gupta accounts amid negative headlines about the family. Tens of millions of dollars moved through the Guptas’ BoB accounts during that year.

Like other foreign banks, the BoB needs a local sponsor bank to work in South Africa. That bank was NedBank. For its transactions, the Indian bank made use of Nedbank’s infrastructure. But this relationship made it possible for the two banks to shift responsibility for the Guptas’ transactions to each other.

For example, Nedbank could perform due diligence on the foreign bank branch itself — but did not have access to money moved between BoB accounts. It was up to BoB to check these clients and oversee those transactions. On the other hand, there was other information the bank could not see, such as the origin of transactions made to BoB accounts from external banks. Partly as a result, neither bank took responsibility for ensuring that the transactions were legitimate.

It remains unclear whether the BoB ever reported any suspicious activities to South Africa’s Finance Intelligence Centre. But one thing is apparent: Nedbank kept it on as a client despite evidence that suspicious activities were taking place. Like other South African banks, Nedbank closed down their own Gupta family-related accounts. Shutting down the BoB, an Indian public sector bank, would have been politically costly, an insider close to Nedbank told OCCRP and The Hindu.

This helped keep the Guptas in the money-moving business even as authorities circled in.

The BoB continued to allow the Guptas’ activities until January this year, when a South African court ordered it to share information about the accounts of more than 20 Gupta-linked companies. This was prompted by a Public Access to Information Request filed by the Helen Suzman Foundation, a local NGO. The bank has said it will release the records in a few weeks.

Prepaying corruption

The transactions related to Tegeta, the mining company, offers an example of the questionable origin of some of the money that circulated within the Gupta accounts.

On April 13, 2016, Tegeta, a joint venture of the Guptas and Mabengela, a company owned by the former President’s son Duduzane, received three deposits totalling 823 million rand ($65 million). The money arrived in Tegeta’s account via several different Gupta-controlled accounts at the Bank of Baroda.

On the same day, the bank employees filed four SARs against the Gupta’s Sahara account. Four more alerts were filed the next day when new transactions came in. But sometime between April 13 and May 2016, BoB officials nullified the alerts, pronouncing the transfers acceptable, which ensured that the Financial Intelligence Centre did not discover them.

Much of the money flowing into Tegeta’s BoB account was South African taxpayer money that came from state-owned entities. From January 2016 through February 2017, Eskom, the state electricity provider, deposited over 1.8 billion rand ($143 million).

Tegeta was a major Eskom subcontractor. In one 2016 deal, it was given a massive 564 million rand ($48 million) contract to supply Arnot, a large power plant, with six months of coal. Eskom had been purchasing coal for an average price of $19.40 a tonne, but Tegeta received more than double that amount. It was the most expensive supply contract on Eskom’s books. Money from this contract was among the millions that flowed into the Guptas’ BoB accounts.

Another deal involving Tegeta stands out: the company’s purchase of the Optimum Coal Mine in April 2016.

Previously owned by Glencore, a multinational commodity trading and mining company, Optimum Coal Mine was a major supplier of coal to Eskom, the country’s electric utility. But there was a hitch: Eskom claimed that the Glencore coal was of a low quality and demanded 2 billion rand ($170 million) in penalties.

Glencore said that, due to the fine, it was no longer profitable to supply Eskom and decided to sell the Optimum Coal company. With a huge penalty on its books that Eskom refused to waive, interested buyers were few.

Then, in December 2015, Tegeta announced that it would buy Optimum Coal for 2.1 billion rand ($160 million). South Africa’s Mines Minister — a known Gupta ally named Mosebenzi Zwane (who had been appointed by President Zuma) — travelled to Switzerland to meet with Glencore and the Guptas. Shortly afterwards, the penalty was waived.

On December 18, 2015, Sanjiv Gupta issued a letter of assurance from the BoB on behalf of the Guptas for payment of 2.1 ZAR billion ($168 million) to lenders of Optimum Coal Mine. The question being asked is whether this was within his powers to do so, an issue that is being examined by the Central Vigilance Commission in India.

There was one more snag. On April 11, 2016, the Guptas informed Glencore that they were 600 million rand ($48 million) short of the sale price. South African banks had declined to lend to Tegeta, by then already perceived as a Gupta-Zuma scheme. Yet by 9 p.m. that night, in a wholly unusual move, Eskom agreed to “prepay” the Gupta companies 659 million rand ($52 million) for future work so that the purchase could be completed. The deal was, at best, an interest-free loan for the Guptas and Zuma, and at worst another plundering of public assets.

BoB records show the Guptas using a series of transactions to pay a total of 1.8 billion rand ($144 million) for the mine. There is no record of what happened to the remaining amount.

Essentially, Tegeta had paid for much of Optimum Coal using taxpayer money from Eskom — which had waived a fee that, according to the mine’s previous owner, had rendered the venture unprofitable.

By 2017, the Guptas’ deals had come under scrutiny, particularly allegedly illegal payments made by state-owned entities like Eskom.

In August 2017, the Guptas announced that Tegeta had been sold for 2.97 billion rand ($225 million) to a Swiss company called Charles King SA. This was an unusual buyer for a mining company, having been formed in February 2011 as a clothing distributor with 50,000 Swiss francs ($53,500) in capital and managed by a financial services firm with a nominee director.

An Emirati named Amir Zarooni, an alleged Gupta proxy, became the company’s sole administrator in August 2017, at which time the company’s registered activity changed simply to “trading.”

Effectively, the deal would allow the Guptas to pay the $225 million for Tegeta to a foreign proxy, placing the money in Switzerland, a foreign tax haven, where it is beyond the reach of South African law enforcement.

There was another financial windfall. When they purchased the Optimum Coal company from Glencore, the Guptas received 1.7 billion rand ($136 million) in “rehabilitation funds”, where are meant to be set aside to mitigate environmental damage and used after the mine had closed. But, in violation of South African law, the Guptas took out loans against this money, moving the funds to their accounts at the BoB, which allowed them to borrow nearly the same amount against the fund in early 2016.

It took until November 2016 for the Bank of Baroda to void the loan. It is not known what the Guptas used the money for. Then, days after former President Zuma resigned, Optimum Coal filed for business rescue —a term relating to a financially “distressed” company seeking assistance. Seven other Gupta-related businesses did too.

Who pays?

The South African authorities say they are seeking to recover as much as 50 billion rand ($4.07 billion) lost through the Guptas’ deals.

In the meantime, the country is struggling. The government has announced plans to slash the national budget by tens of billions of rand, and raise taxes, including VAT and fuel levy. Meanwhile, Eskom is so financially strapped that it has sought steep increases in electricity tariffs for South African consumers.

The Guptas and Essa did not respond to questions sent by reporters. BofB officials in South Africa also did not respond to questions.

In a statement, the bank’s Indian head office said: “The South African operation of the bank has always been and continues to be conducted in accordance with the laws and regulations of the home and host country regulators.”

“To date, neither the South African regulators nor the independent auditors it has appointed to review these accounts and transactions have found that the bank’s South African territory engaged in any intentional wrong doing.”

Nedbank also denied any wrongdoing saying, “In respect of all of our clients, including the BoB’s SA branch, Nedbank has a responsibility to apply anti-money laundering regulations, ‘know-your-client’ procedures and report all suspicious transactions to the Financial Intelligence Centre. Nedbank has a robust system to comply with its know-your-client and suspicious transaction reporting obligations.”

(Sylke Gruhnwald